Are you currently in the middle of an important decision about your career path after completing your education? The options can be overwhelming, especially when it comes to BCom (Bachelor of Commerce) and BBA (Bachelor of Business Administration) degree options. Both degrees lead to promising careers, but which one is right for you? In this comprehensive guide, we will explore the key considerations when deciding between a BCom and a BBA after l12th in 2024. We will examine the differences in curriculum, career opportunities and skill set of a degree each gives in. Amrita AHEAD Online Program aligns with your interests, strengths, and long-term goals. Whether you’re interested in accounting, finance, marketing, business, or entrepreneurship, this guide will provide you with valuable insights to help you make informed decisions. So, let’s start your journey to finding the perfect degree to succeed in the dynamic world of marketing.

Bachelor of Commerce (BCom) degree dives deeper into the financial and accounting aspects of business. It equips you with strong analytical and quantitative skills, preparing you for careers in finance, accounting, taxation, and auditing

BCom graduates are highly sought-after in various industries, including:

Banking & Financial Services: Manage investments, analyse financial markets, and provide financial advice.

Accounting & Auditing Firms: Conduct audits, prepare financial statements, and ensure compliance with financial regulations.

Taxation & Consultancy: Advise clients on tax matters, prepare tax returns, and navigate complex tax laws.

Government & Public Sector: Work in government agencies, managing finances, analysing economic data, and formulating policies.

Master of Commerce (MCom): Expertise in specific areas like accounting, finance, or taxation.

MBA: Broaden your business knowledge and acquire leadership skills with a prestigious MBA degree.

Chartered Accountancy (CA): Pursue the highly respected CA qualification for a lucrative career in accounting and finance.

Professional Certifications: Enhance your specific skills with certifications in areas like financial analysis, data analytics, or risk management.

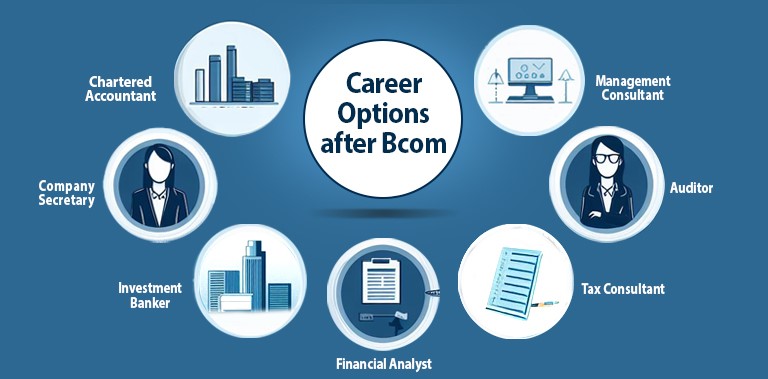

There are a multitude of career options that one can pursue after their BCOM.

Chartered Accountant (CA): This is a highly respected and sought-after qualification that opens doors to a wide range of opportunities in accounting, finance, and auditing.

Company Secretary (CS): Company secretaries are responsible for ensuring that companies comply with all legal and regulatory requirements. They also play a key role in corporate governance and decision-making.

Investment Banker: Investment bankers help companies raise capital and advise them on mergers and acquisitions. This is a high-pressure and competitive field, but it can also be very rewarding.

Financial Analyst: Financial analysts assess the financial health of companies and make recommendations to investors. This is a data-driven role that requires strong analytical and quantitative skills. To become a financial analyst, you typically need a bachelor’s degree in finance or accounting and relevant work experience.

Tax Consultant : Tax consultants help individuals and businesses comply with tax laws and regulations.

Auditor: Auditors assess the financial statements of companies to ensure that they are accurate and complete. This is a critical role that helps to protect investors and the public.

Management Consultant: Management consultants help businesses improve their operations and performance. This is a broad field that encompasses a wide range of specialties, such as marketing, finance, and human resources.

Financial Accounting & Analysis: Master financial accounting principles, analyse financial statements, and interpret financial data.

Taxation & Compliance: Gain in-depth knowledge of tax laws, regulations, and compliance procedures.

Auditing & Assurance: Develop the skills to conduct audits, assess internal controls, and ensure financial reporting accuracy.

Quantitative & Analytical Skills: Sharpen your ability to analyse data, solve complex problems, and make informed decisions.

Communication & Presentation Skills: Communicate financial information effectively, both verbally and in writing.

Bachelor of Business Administration (BBA) is a coveted undergraduate application that focuses on imparting college students with a comprehensive understanding of commercial enterprise control and administration. It is designed to put together people for management roles in numerous industries.

Management Principles: BBA introduces college students to fundamental ideas of management, covering topics like planning, organising, directing, and controlling inside an organisational context.

Marketing Management: BBA packages encompass publications in advertising control, equipping students with the skills to increase and put into effect effective advertising and marketing strategies.

Financial Accounting: Understanding economic statements, budgeting, and monetary analysis are indispensable additives of BBA, supplying college students with a stable foundation in financial management.

Human Resource Management: BBA delves into the intricacies of human resource management, addressing topics which include recruitment, schooling, overall performance appraisal, and employee relations.

Operations Management: BBA applications cover the essentials of operations management, which include supply chain control, production making plans, and first-rate management.

Business Ethics and Law: BBA college students discover the moral and legal dimensions of enterprise, ensuring they understand the obligation and criminal responsibilities associated with company practices.

Entrepreneurship: BBA encourages an entrepreneurial mindset, offering courses that foster creativity, innovation, and the capabilities needed to begin and manipulate organisations.

Business Analyst: BBA graduates with strong analytical capabilities can pursue roles as commercial enterprise analysts, assisting companies make information-pushed selections.

Marketing Manager: Those that specialise in marketing inside BBA can come to be advertising managers, overseeing the improvement and execution of advertising techniques.

Financial Analyst: BBA gives a solid monetary foundation, making graduates suitable for roles as economic analysts who determine monetary facts and trends to guide funding choices.

Human Resources Manager: BBA equips college students for careers in human assets, in which they are able to take on roles as HR managers liable for employees management and organisational improvement.

Operations Manager: BBA graduates focusing on operations control can excel as operations managers, overseeing the performance of commercial enterprise approaches.

Entrepreneur: With a focal point on entrepreneurship, BBA prepares college students to start and manipulate their corporations, turning progressive ideas into hit ventures.

Management Consultant: BBA graduates can paint as control specialists, presenting advice on organisational strategies, tactics, and problem-solving.

Business Acumen: Gain a holistic understanding of core business functions like finance, marketing, operations, and human resources.

Leadership & Communication: Cultivate strong leadership skills, effective communication, and the ability to motivate and collaborate.

Problem-Solving & Decision-Making: Hone your analytical thinking, data analysis skills, and critical decision-making capabilities.

Technology Savvy: Develop proficiency in using digital tools and software essential for modern business operations.

Areas of Running a Company After BBA:

Marketing & Sales: Drive brand awareness, create winning marketing campaigns, and excel in sales strategies.

Finance & Accounting: Manage finances effectively, analyse financial data, and contribute to strategic financial decisions.

Operations & Logistics: Optimise operational efficiency, manage supply chains, and ensure smooth business processes.

Human Resources: Attract top talent, foster positive work environments, and manage employee relations effectively.

Entrepreneurship: Launch your own venture, equipped with the knowledge and skills to navigate the startup ecosystem.

Course Curriculum | Bcom | BBA |

| Semester 1 | Communicative English Accountancy Principles of Management Basic concepts of Mathematics Business and MIS Economics for Decision Making | Communicative English Principles of Management Financial Accounting Business and MIS Basic Concepts of Mathematics |

| Semester 2 | Professional Communication Advanced Accountancy Company Law Business Statistics and Operations Research Environmental Science and Sustainability Fundamentals of Costing | Professional Communication Business Organization and Systems Business Economics Environmental Science and Sustainability Business Laws Business Statistics |

| Semester 3 | Corporate Accounting Insurance and Risk Management Introduction to GST Banking Management Accounting Introduction to International Finance Reporting Standards | Organisational Behaviour Introduction to Marketing Management Banking and Insurance Cost and Management Accounting ELECTIVE from Category 1 Quantitative Techniques |

| Semester 4 | Auditing – Principles and Practices Elective A Introduction to Research Projects Principles of Financial Management Accounting Packages –Tally Mercantile Laws Accounting Packages – Tally Lab Customs Law – Practice and Procedure | Advanced Marketing Management Basics of Human Resources Management Introduction to Research Methods Financial Management Production and Operations Management ELECTIVE from Category 2 |

| Semester 5 | Capital Markets and Financial Services Investment Management Corporate Finance Elective B Elective C Direct Taxes and Indirect Taxes | Principles of International Business Business Ethics and Corporate Social Responsibility CORE ELECTIVE from Category 3 CORE ELECTIVE from Category 3 Introduction to Strategic Management Sustainable Business Administration |

| Semester 6 | Elective E Elective F Entrepreneurial Development Elective D Project | CORE ELECTIVE from Category 1 CORE ELECTIVE from Category 2 CORE ELECTIVE from Category 3 Education for Life Internship |

Eligibility Criteria for BCom and BBA Programs

Online degrees are essentially the way ahead in today’s world of technology. Its flexibility, accessibility, or cost-effectiveness are the main factors that have made online degrees more desirable to those who seek prosperous careers. Go AHEAD with Amrita AHEAD Online BBA and BCom programs to enhance your learning opportunities.

Both BCom and BBA online undergraduate programs come with myriad benefits. Students can apply for scholarships, avail easy financing options for fee payment, access live as well as pre-recorded lectures through our official website for Amrita AHEAD. We offer online learning materials, attend webinars from industry experts, and get placement support.

The courses are solely designed to build competencies required in the field of commerce, attuned to the latest pedagogy. Amrita AHEAD prepares you for many contours in the arena of you advancement in career So, make the right decision for a bright future ahead.

The choice between B.Com (Bachelor of Commerce) and BBA (Bachelor of Business Administration) depends on your professional dreams and interests. Both ranges offer distinctive views and can cause numerous career paths. These are key elements to consider for both programs.

B.Com (Bachelor of Commerce)

Scope: B.Com offers a broader knowledge of trade and alternate. It covers areas like accounting, finance, economics, and enterprise regulation.

Versatility: B.Com graduates can find opportunities in diverse industries, consisting of finance, banking, coverage, accounting, and company sectors.

Professional Qualifications: B.Com is a suitable basis in case you plan to pursue expert qualifications like Chartered Accountancy (CA), Cost and Management Accountancy (CMA), or Company Secretary (CS).

BBA (Bachelor of Business Administration):

Management Focus: BBA is more centered on control and management. It covers topics like advertising, human resources, operations, and organisational behavior.

Early Exposure: BBA packages regularly provide realistic exposure to commercial enterprise situations, helping students increase control abilities early in their instructional adventure.

Corporate Opportunities: BBA graduates are nicely accepted for access-level control positions in numerous industries. The diploma can also pave the way for pursuing an MBA (Master of Business Administration) for in addition specialisation.

Considerations:

Personal Interests: Choose the program that aligns with your hobbies and career dreams. If you’re more interested in finance and accounting, B.Com may be a higher suit. If you’re interested in management and leadership roles, BBA might be the right preference.

Future Plans: Consider your long-time period desires. Inorder to pursue better training, along with an MBA, BBA is probably an extra direct direction. If you aim for a selected professional qualification like CA or CMA, B.Com may be more suitable.

Ultimately, each B.Com and BBA have sufficient career opportunities, and success relies upon your abilities, pastimes, and how properly you leverage your degree inside the selected discipline. It’s advisable to research particular career paths, enterprise developments, and activity requirements to make a knowledgeable decision primarily based on your aspirations.

You May Like